Curve was founded by Michael Egorov, a Russian physicist and entrepreneur who had previously co-founded an encryption protocol for big data called NuCypher, in early 2020. While serving as NuCypher’s CTO, Egorov studied the concepts of liquid staking and bonding curves, which ultimately led him to develop an algorithm designed for low-slippage trading within an Ethereum smart contract. This algorithm became the foundation of Curve finance, which Egorov later launched in January 2020.

DeFi 101

The Tie Research

DeFi 101: Curve Finance

Introduction to Curve

Curve Finance is an automated market maker(AMM) platform built on Ethereum that is optimized for low fees and slippage. This is accomplished through use of liquidity pools that are composed of assets with similar price behaviors (e.g., stablecoin pairs, or ETH-WETH). While there are many decentralized exchanges that enable token swaps, Curve has been able to position itself as a pioneer in the space, launched during a time when DeFi primitives were nascent and liquidity fragmentation was omnipresent.

Value Proposition

AMM Overview

An Automated Market Maker(AMM) is the underlying infrastructure that drives a decentralized exchange (DEX). AMMs serve the same purpose as their traditional counterparts, facilitating the exchange of two digital assets.

In contrast to traditional markets, which generally rely on big banks or market-making firms, AMMs use a smart contract to price assets algorithmically. By eliminating both the need for a custodial entity to create markets and the necessity for trade counter-parties, AMMs are able to decentralize the decision-making process of pricing assets and facilitate on-chain liquidity bootstrapping.

Constant Product Market Makers (CPMMs) are the most broadly implemented family of AMMs, and can be generalized using the formula ‘x*y=k’. “Constant” refers to the contract condition that the product of the asset reserves must remain constant as new trades flow in.

In the formula, (x) represents the value of reserve token A, and (y) represents the value of reserve token B. K is a constant parameter defined by the protocol or pool creator. For instance, if an investor decides they want to swap ETH (token A) for wBTC (token B) via a CPMM model, they are effectively removing wBTC from the ETH/wBTC liquidity pool while simultaneously adding ETH into it.

The AMM then responds to this by increasing the price of wBTC and decreasing the price of ETH to keep the pool balanced within the model's parameters. It’s important to note that AMMs do not change their prices based on the other markets around them. The price of an asset inside the pool only moves as the ratio of the reserve shifts.

AMM Pain Points

AMMs such as Uniswap, Balancer, and Curve have seen massive growth over the years, with transaction volumes in the billions of dollars. With that said, this technology is still new, and comes with its own set of growing pains. These issues generally manifest in impermanent loss, high fees, and high slippage.

Impermanent Loss

Impermanent Loss(IL) is the difference in value over time between holding two tokens in your wallet and depositing them into a liquidity pool. As mentioned above, AMMs are constantly rebalancing based on token withdrawals and deposits. As prices of the reserve tokens start to fluctuate, the rising side is being sold by the AMM and replaced by theother asset to keep the liquidity pool at its predetermined ratio.

To specifically illustrate how this can create issues, let’s go through a scenario where an investor supplies 10 ETH and 1 wBTC to a 50/50 liquidity pool. At the time of entry into the pool, 1 wBTC = 10 ETH, so the total value of the investor's initial liquidity provided is 10 ETH +1 wBTC (10 ETH) = 20 ETH.

Now let’s say that shortly after supplying liquidity, the price of wBTC drops down to 7 ETH. To maintain the constant ratio of 50/50, the AMM will continuously sell the ETH until the balance is restored. The investor’s tokens in the pool are now worth 7 ETH + 1 wBTC (7 ETH) = 14 ETH. If the investor had kept 1 wBTC and 10 ETH outside the pool instead of supplying liquidity, his tokens would have been worth 1 wBTC (7 ETH) + 10 ETH = 17 ETH, resulting in an impermanent loss of 3 ETH. The logic behind the name is that the value of the token balance in the liquidity pool may eventually recover or even rise, deeming the loss "impermanent". In practice, impermanent loss is oftentimes more permanent.

To compensate for their potential loss, liquidity providers are continuously rewarded with a pro-rata share of trading fees accrued through swaps on the pool. These fees are paid by every user that interacts with the liquidity pool, and are generally a fixed percentage of the trade value. Due to the lack of transparency from DEXs on IL, there have since been multiple external studies showing the truth behind liquidity provider profitability. Bancor and Topaz Blue published a study stating that 49.5% of LPs lose money. The Defiant found that 52% of LPs utilizing Uniswap V3 were also unprofitable.

Slippage

Slippage occurs when there isn’t enough liquidity to fulfill an order at the exact price it was executed. This can cause a substantial shift in the price of an asset from the time an order is placed to when it gets completely filled. This is especially true when an investor is trying to place a market order with relatively large size, forcing larger investors to default to execution strategies such as TWAP(Time Weighted Average Price).

Slippage can also occur when trading activity is high. When executing a trade on a DEX, your transaction is put in a queue. The longer the queue, the longer it takes for your transaction to process on the blockchain, and the greater a chance of a disparity between the price you thought you were getting and the price you got filled at.

An iteration of the CFMM that can be used to solve for slippage is the linear invariant model described as the constant sum function (x+y=k) and can be visualized as a straight line. Constant sum market-making enforces a consistent quantity of two assets within a pool, resulting in a meaningfully reduced chance of slippage occurring.

With that being said, while the implementation of the constant sum eliminates the risk of slippage and is efficient for stabilizing price fluctuations, it can result in the entirety of a pool's liquidity being drained. In contrast to the constant product function (xy=k), which always has scaling liquidity.

Curve’s Optimized AMM

Over the years as more money flows have come into DeFi, several decentralized exchanges have modified the constant function formula to optimize for different use cases. For instance, exchanges like Uniswap and Balancer are designed to support a broad range of volatile tokens, making the constant product and constant sum function suitable options for token pricing and swaps. The problem, as mentioned above, is that a constant product AMM can be expensive to keep balanced, while a constant sum AMM can simply run out of tokens at any time.

Curve finance directly addresses these pain points by using liquidity pools comprised of similarly priced assets(e.g., stablecoins, vault tokens, wrapped bitcoin,etc). This system is facilitated by implementing a hybrid AMM model,known as the stable swap invariant,- that utilizes both constant sum and constant product functions to create deeper pockets of liquidity that soften price impact within a range of transactions.

As shown in the image above, the stable swap variant creates a hyperbola (blue line) that behaves like a constant sum for large parts of the price curve, and transitions to a constant product only when a liquidity pool is limit-tested to ensure that liquidity is available as prices fluctuate. This design enables low-price impact swaps between similar assets while also significantly reducing the risk of impermanent loss. Additionally, because capital within pools is used efficiently, Curve is able to offer significantly lower trading fees than its competitors (e.g., Curve’s 0.04% fee compared to Uniswaps 0.3%), 50% of which is distributed to liquidity providers.

Furthermore, Curve Finance’s composability has been a crucial factor in the sustained growth that it’s seen since its launch. Instead of relying solely on trading fees, some pools on Curve leverage interest rates and rewards from other protocols to further incentivize liquidity providers. For instance, the largest pool on Curve is the ‘stETH’ pool with over 2bn in TVL; aside from CRV token rewards, liquidity providers inside the stETH pool are partially paid in LDO tokens, the equivalent representation of an additional 5.5% APR.

Tokenomics

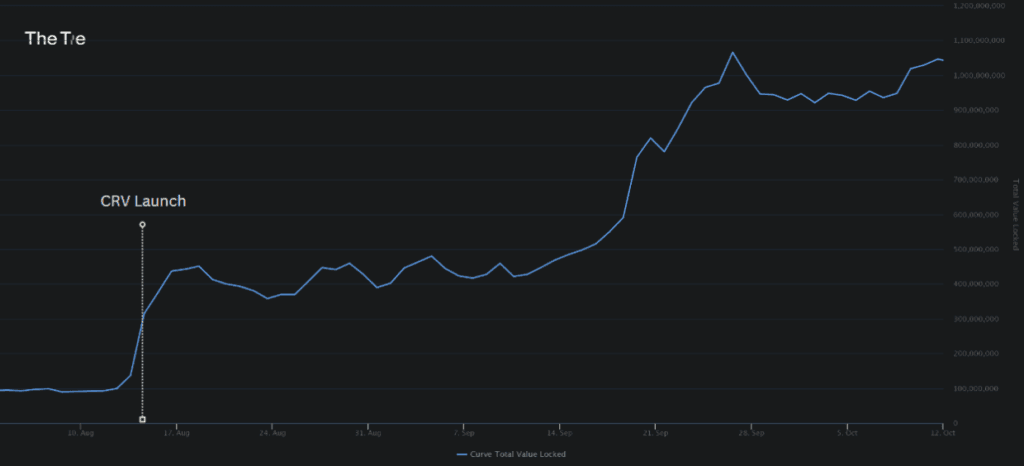

Curve’s token (CRV) was launched on August 13, 2020, as retail started to pour into the space in search of yield opportunities. The token launch resulted in an immediate surge in user activity on the platform, with TVL nearly tripling within 24 hours, and increasing by 740% (>$1bn) by the end of the summer, cementing Curve’s position as the top decentralized exchange for stablecoins,

CRV Supply and Distribution

The CRV token was launched with an initial supply of 1.3 billion tokens, or 43% of the maximum supply of 3.03 billion tokens. The distribution for the initial allocation is as follows:

- (5%) to pre-CRV liquidity providers with 1 year vesting

- (30%) to shareholders (team and investors) with 2-4 years vesting

- 3% to employees with 2 years vesting

- 5% to the community reserve

The final distribution for the entirety of the 3.03 billion token supply is as follows:

- 62% to community liquidity providers

- 30% to shareholders (team and investors) with 2-4 years vesting

- 3% to employees with 2 years vesting

- 5% to the community reserve

The initial emission rate is about 2 million CRV tokens issued each day, distributed as rewards across all live liquidity pools. As shown in the image above, the inflation rate starts off high but starts to decrease meaningfully until the 3.03 billion maximum supply is reached,

CRV Use-Case

Curve’s CRV token is a governance token that was created to facilitate the alignment of incentives between the community, liquidity providers, and investors. While the most prominent use-case for the token is to incentivize liquidity (as shown in the immediate surge in TVL post-token launch), governance voting, staking, and boosting rewards have grown in importance over time.

To access these use cases, token holders must lock up their CRV for a predetermined period, and, in turn, receive a non-transferrable derivative token called veCRV (vote-escrowed CRV), which represents their locked tokens.

The number of tokens and the duration for which the tokens are locked are used to weigh voting power and liquidity rewards. The greater the voting power or rewards, the longer the lock-up period. Token holders can lock their CRV for as little as a week and as long as four years, generating the highest rewards for staked users who are willing to align with the protocol long-term (up to a 2.5x boost). As of the time of writing, 51.51% of CRV tokens are locked with an average lock time of 3.53 years, indicating that the general consensus amongst token holders regarding the protocols' long-term success is quite bullish.

Governance is arguably the most important use-case for the CRV toke, with particular emphasis on gauge weights. As mentioned, a majority of the total CRV supply is distributed amongst liquidity pools on the platforms. The amount of rewards distributed to each pool depends on each pool's gauge weight.

Gauge weights are the percentage of CRV emissions that are rewarded to specific liquidity pools, and are voted upon on a weekly basis by veCRV holders. The liquidity pools that get the most votes are rewarded the most tokens. The implementation of gauge weights started a battle amongst many different protocols, which lasted for the greater part of 2021, known as the “Curve Wars”. Projects with pools on Curve started to look for ways to ‘bribe’ veCRV holders into voting for their pools as a direct way to increase their revenue and TVL.

As time went on and the dust of battle started to fade, a clear winner stood at the top. Convex finance launched as a layer on top of the Curve model that facilitated the involvement of retail money that wanted to benefit from Curve’s incentive model without having to lock up their tokens for long periods. CRV holders who stake their tokens on Convex receive a derivative token called cvxCRV. In doing so, CRV stakers effectively give up their voting power to Convex.

In return, they are being offered the same returns that Curve offers, with the added benefit of additional CVX token rewards through project bribing. Convex’s sustained growth has led them to implement their own version of Curve’s governance model through their governance token vlCVX (vote-locked Convex), which enables CVX holders to vote on how Convex should deploy their accumulated veCRV. As of the time of writing, Convex controls 47% of the current supply of veCRV and is continuing to grow its influence over the protocol.

Risks & Considerations

Despite Curve’s exponential growth since its launch, the CRV token has failed to outperform its peers (shown in the image above). Below are a few concerns that should be kept in mind when considering the valuation of the token.

- High Inflation - Curve’s issuance schedule is aggressive when compared to its competitors. This high dilution is especially relevant in an environment with lower demand for liquidity and a risk-off macroenvironment.

- Security - Like all protocols, Curve is susceptible to general smart contrast risks. While Curve is deemed secure by auditors, there are no guarantees of security. With that said, Curve has thus far withstood the test of time without any major exploits.

- Competition - Curve has a clear first-mover advantage and has established itself as the decentralized exchange for stablecoins. With that said, it’s entirely possible that newer iterations of competing platforms could implement tighter spreads for stablecoins and more accessible incentives, resulting in the dilution of Curve’s market share over the AMM space.

Curve Stablecoin (crvUSD)

At the center of Curve’s stablecoin innovation is their Lending-Liquidating AMM Algorithm (LLAMMA). In traditional CDP (Collateral Debt Position) stablecoins, undercollateralized positions are liquidated in order to maintain the peg. The issue with full liquidations is that cryptocurrencies are generally high-beta-risk assets, meaning that their inherent volatility supplements the increased risk of cascading liquidations.

There are arguments that partial liquidations serve as a more efficient alternative to full liquidations, but they come with pain points of their own;

- If a large number of liquidations are required for the same commitment, liquidators may be stressed and struggle to keep up if the market continues to move downwards, posing a risk to protocol solvency.

- If full liquidation is eventually required, doing so through a series of partial liquidations would result in the user losing more collateral than a single full liquidation.

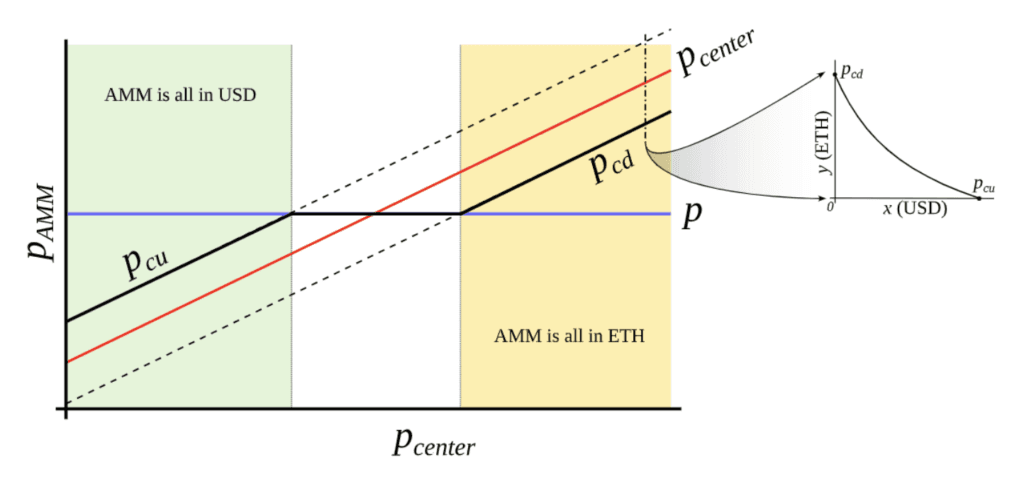

Curve’s stablecoin introduces the concept of continuous liquidation and deliquidation. Using ETH and USD as an example, when a user initially deposits ETH as collateral, their portfolio consists solely of that initially deposited asset (in this case, ETH).

Once deposited, the LLAMMA observes the price of ETH (Pcenter) and reacts according to price fluctuations within a concentrated liquidity range (Pcu to Pcd). For example, if the collateral price decreased to (Pcu≤), the protocol would liquidate the user’s ETH fully into crvUSD. In contrast, if the price increases to (Pcd≥), the user will automatically be fully in ETH.

While liquidations are still technically possible, Curve’s liquidation and deliquidation mechanism represents a significant improvement to current CDP systems, as it reduces liquidation risk without imposing bad debt.

It’s important to note that Curve’s stablecoin could create implications within DeFi that extend beyond a novel liquidation mechanism. As we know, Curve is optimized for low slippage and trading fees. However, exchangeable tokens on the platform are limited to pegged assets, creating a bottleneck on which assets investors can use in Curve’s architecture.

This is where we see the potential of Curve’s LLAMMA as a bridge for enabling low-fee swaps across a broader basket of tokens. Each time a new collateral is deposited inside the LLAMMA ecosystem, a new liquidity pool paired with crvUSD is created (e.g., ETH/crvUSD). While there’s limited information regarding the fee structure, Curve could hypothetically introduce fee-free trading, while still generating enough revenue from liquidations to be profitable. Coupled with Curve’s credibility as a long-standing blue chip protocol, implementing a low fee structure for a broad basket of assets could result in crvUSD being one of the most utilized stablecoins in DeFi.

Conclusion

Curve has become a vital lego block for DeFi by sourcing and provisioning liquidity in a decentralized and accessible way. The value add that Curve has brought to space has enabled the growth of several blue-chip protocols on the back end and has sparked new areas of tokenomics research, ultimately leading to new liquidity provisioning models throughout DeFi. While there are some concerns regarding its valuation, Curve remains the top decentralized exchange in TVL and is thus expected to sustain its growth in tandem with the broader DeFi sector.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor

Sign up to receive an email when we release a new post