Bitcoin and Ethereum introduced step-wise improvements over traditional financial rails by settling transactions much more quickly (weeks reduced to minutes), limiting or eliminating third-party risk, and removing banking constraints like payment processor agreements, limited hours of operations, and international transfer overhead.

The Tie Research

Beyond Ethereum: The Role of 3rd-Gen Blockchains in Driving Mass Adoption

Introduction

Despite the cryptocurrency market dominance of Bitcoin and Ethereum by market capitalization, (~67% of total market cap), the total number of users of these blockchains remains low around 100s of millions relative to the total addressable market of global internet users at 5.18 billion.

So, the question remains - if Bitcoin and Ethereum are so great, why don’t more people use cryptocurrencies?

Beyond considerable technical knowledge and user experience hurdles that hinder all cryptocurrency networks and apps, first and second-generation blockchains (Bitcoin and Ethereum, respectively) lack native scalability, the ability to handle increased demand without harming user experience through longer time-to-finality or noticeably higher fees. Their ability to scale relies on third-party solutions such as the Lightning Network or “L2s” that add risk and necessitate even further education to use.

Blockchain networks created with native scalability, deemed "third-generation" or "alt L1" blockchains, reduce network complexity by limiting or eliminating interfaces with third-party solutions, and ultimately lead to more secure, faster-finalizing networks more suitable for mass adoption through payments and decentralized applications (dApps).

Before we dive into payments and dApps, let’s first examine the state of Ethereum followed by a comparison with third-generation blockchains broadly.

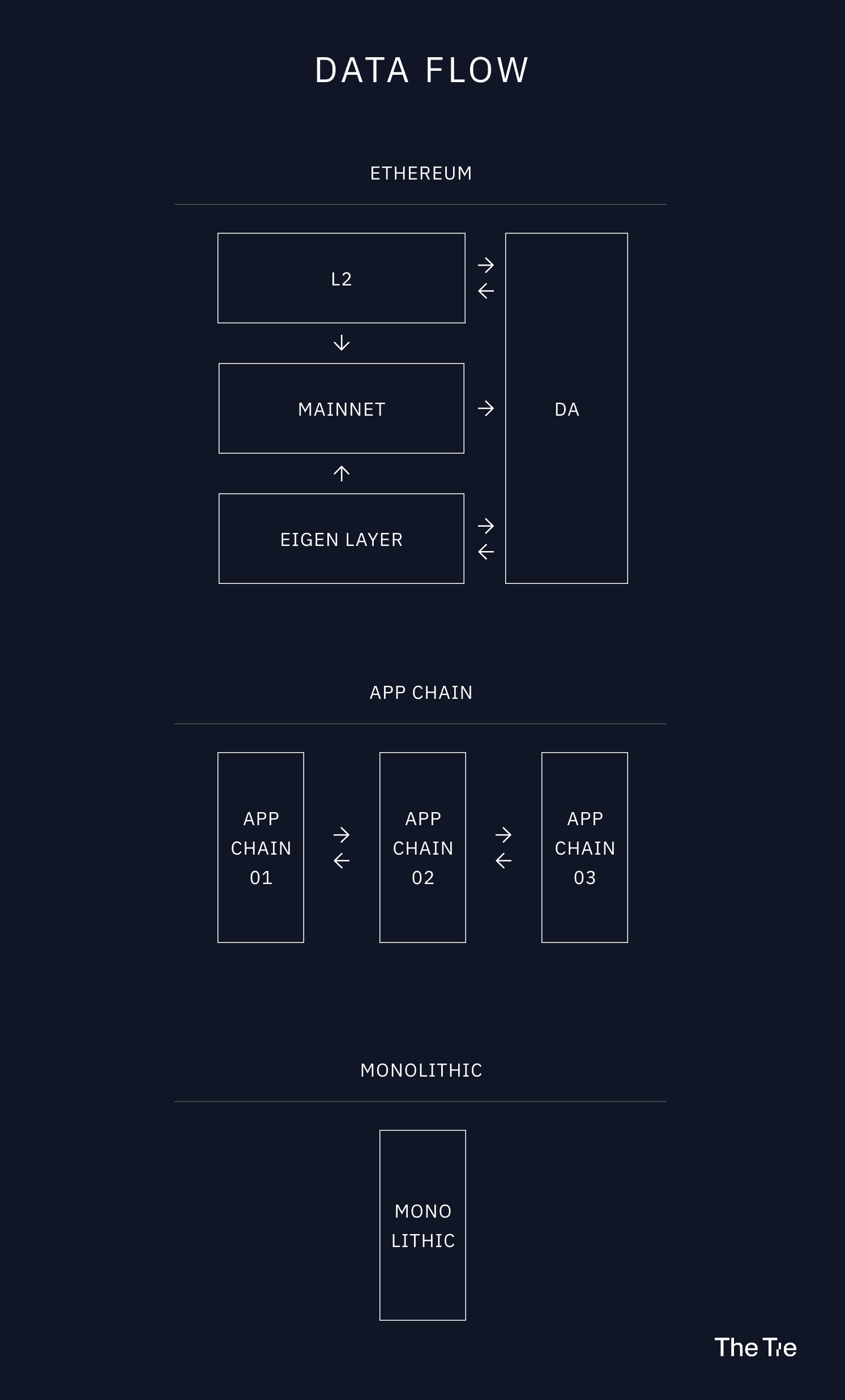

Ethereum

Ethereum mainnet consists of a single blockchain secured by 23.5m ETH (currently ~$38.7b), ensuring a high cost of network corruption i.e., strong economic security. However, when demand for Ethereum mainnet blockspace is high, single transactions can be cost-prohibitive for most users (> $100).

To improve Ethereum's mainnet scalability, many Ethereum ecosystem projects use L2 blockchains to make transactions less expensive. L2 blockchains inherit security from the base layer and execute computation on a secondary blockchain that later settles on Ethereum mainnet. This approach gives the Ethereum mainnet its tagline as "a global settlement layer," similar to a settlement bank in traditional finance.

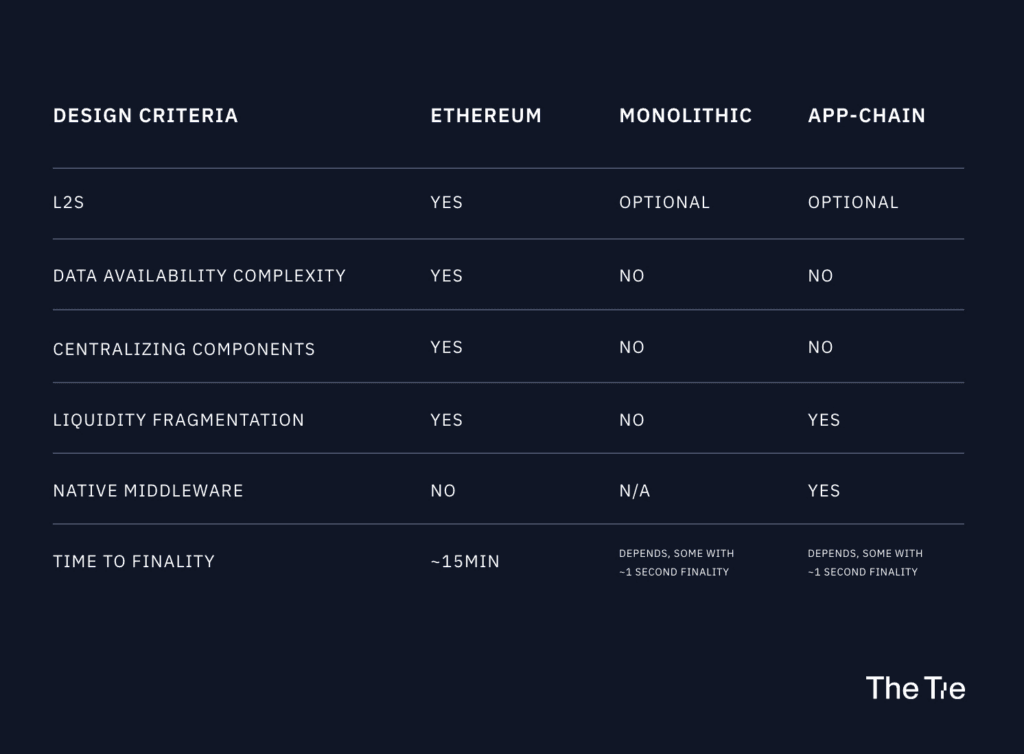

The L2 scaling design necessitates that the Ethereum ecosystem interfaces with several other categories of third-party solutions, including data availability solutions and middleware, to scale and interoperate. While these solutions address their respective problems, third-party interfaces introduce new risks, user experience issues, and delayed time-to-finality. Let's walk through the challenges in more detail before seeing how third-generation blockchains address them.

Data Availability

Data availability is the assurance that a block has been distributed and verified by all of the full nodes (the storers of the entire history of the blockchain) in the network. L2s require strong assurances that historical data is available but would slow down to L1 speeds if they downloaded all of the historical data. To address the data availability problem, solutions like Celestia, Avail, and EigenDA use cryptographic proofs to ensure data is available for L2 blockchains. These solutions become a dependency for proper L2 function, adding to the overall risk profile of the L2.

Centralized Components

L2s currently all have centralizing components, whether it be sequencers or provers. Centralized sequencers can alter transaction ordering (presenting maximal extractable value opportunities) and censor transactions or users. Provers or proof generators demand computational resources that most people can't readily acquire, pairing down the number of potential provers. Centralized points of failure add to the risk profile of transacting on an L2 because they make the network easier to corrupt. Coinbase, for instance, is the sole sequencer for the Base L2, meaning Base could be censored by Coinbase or by US regulation.

Some projects like Espresso, Astria, and NodeKit aim to address the centralized sequencer problem through shared sequencers. Other projects like Scroll, ZkSync, and Polygon are working to improve performance and reduce the computation demand of zero-knowledge proofs.

Liquidity Fragmentation

By scaling through L2s, liquidity generally moves from the L1 to the L2, where the decentralized applications (dApps) live. Less liquidity means more slippage and volatility for L1 users. dApps rely on third-party messaging layers and bridges like LayerZero and Axelar to unify liquidity, which add risk and impose trust assumptions of multi-signature wallets that are unknown to most users. Alternatively, L2 dApps could operate solely within the L2 and suffer from smaller markets.

Securing Middleware

Because there is no native messaging layer between L2s, asset transfers involving L2s are facilitated through third-party bridges. Most bridges must source their security (the cost to corrupt the network), making them a popular attack vector. According to CoinDesk, In 2022 alone, bridge exploits accounted for over $2 billion.

To address the middleware problem, solutions like Eigenlayer rehypothecate Ethereum stake to create customizable networks. In other words, Eigenlayer stakers stake on their choice Eigenlayer network and again in Ethereum using the same funds. While Eigenlayer has many other applications, one primary use case for Eigenlayer is to secure middleware infrastructure like bridges and messaging layers.

In a recent blog post entitled "Don't Overload Ethereum's Consensus," Vitalik Buterin, co-founder of Ethereum, lays out the potentially catastrophic risk of ETH stake rehypothecation, especially if the application recruits Ethereum's social consensus. Such applications could lead to a network fork, causing severe penalties for Eigenlayer and Ethereum stakers and posing a security threat to both networks.

Long Settlement Times

Much like how services like Venmo or CashApp give the appearance of instant finality, L2s also offer the appearance of instant finality; however, transactions on L2s can only be considered final after they settle on the Ethereum mainnet. In other words, an L2 user may make a transaction, see the balance in their wallet change, and their transaction can still be reverted. The current finality time for an Ethereum transaction is ~15 minutes, giving the minimum time for any transaction to be considered final in the Ethereum ecosystem. At times, finality on the Ethereum mainnet has taken longer; in May 2023, Ethereum stopped finalizing transactions for about an hour.

Third Generation Blockchains

There are generally two ways third-generation blockchains have approached the scaling problem: monolithic architectures like Solana (a single L1 blockchain) and app-chain architectures (deploying many L1 blockchains) like Avalanche and Cosmos.

Let's examine how third-generation blockchains address the problems mentioned above:

- Data Availability - With L1s, full nodes can verify they have all the necessary data to produce the next block and that all the other full nodes have received that block.

- Centralizing Components - By scaling through an L1, there is no need for sequencers or provers, so the network is as decentralized as the consensus allows.

- Liquidity Fragmentation - Monolithic architectures already have unified liquidity within their ecosystem. App-Chain architectures currently fragment liquidity but can have a primary liquidity hub (like the Avalanche C-Chain) or, in the future, unified liquidity through a native messaging layer (e.g., Avalanche Warp Messaging or Inter-Blockchain Communication).

- Securing Middleware - While monolithic and app-chain approaches rely on third-party bridging and messaging for external communication, they communicate within their ecosystems with minimal added risk. For external communication, only the funds in the bridge are at risk - not network stake.

- Long Settlement Times - Many third-generation blockchains have fast settlement times, with the fastest having subsecond time-to-finality (Solana ~5 seconds, Avalanche ~1 second, Cosmos ~1-2 seconds).

Payments and Dapps

Different blockchains offer advantages that are more optimized for certain use cases. There are many reasons people would choose to use Ethereum; it has the most mind share, the deepest markets, and great economics for Ether (ETH) holders. Some high-net-worth borrowers may readily accept longer finalization periods and higher fees as a worthwhile trade for access to Ethereum's deep markets.

However, the prospect of mass adoption of blockchain technology through payments and dApps necessitates a different balance of trade offs.

Payments

Would money users prefer near-instant settlement or settlement that takes several minutes? Near-instant, of course. A near-instant settlement assures that once a user's wallet balance changes, it won't revert. In the case of peer-to-peer settlement, both parties benefit from knowing payment is near-instant and irrefutable.

Money users also generally prefer a unified money management experience to a fractured one. For instance, managing money between multiple investment accounts, payment processors like Venmo and Paypal, bank accounts, loyalty rewards programs, gift cards, and credit cards can be very complicated. Splitting funds between L1s and L2s adds roughly twice the complexity , especially when users can pay considerable fees moving funds between them or wait significant amounts of time to move from the L2 to L1 (potentially weeks if moved natively).

Beyond settlement times and unified liquidity, the ideal payment system has negligible transaction fees. A core benefit of cryptocurrencies is that peer-to-peer transactions are significantly more efficient and cheaper than in traditional finance. However, payments using Ethereum are largely untenable for the average person.

With Ethereum, a user must either pay a mainnet gas fee to transfer funds to the L2 for "instant settlement" (and be subject to centralization risk and fragmented liquidity without native messaging) or use the L1 and pay mainnet user fees per transaction. Furthermore, the L2 payment system punishes those with lower fund balances because bridging funds from the L1 to the L2 can be expensive. Those with lower L2 balances will frequently be forced to pay this fee to bridge to the L2. Compare this undesirable payment experience to third-generation blockchains like Solana or Avalanche with negligible transaction fees (< $0.01).

dApps

If you're managing your finances on-chain, you want to be certain about the state of the blockchain, which is sometimes in question for re-organizing blockchain like Ethereum.

Imagine you're an e-sports GameFi professional playing a tournament game. The winner of this game is rewarded the equivalent of $30,000. After months of practice and sacrifice, you win the game and the $30,000! Congrats! After several minutes, you recheck your wallet balance to show your friends and family, and it's gone. Ethereum had difficulties finalizing, the new version of Ethereum doesn't recognize you as the winner, and you're now out $30,000.

Or imagine you're a DEX trader making profitable trade after trade by arbitraging small-cap tokens. After hours of trades, you check your wallet balance and realize you're missing hundreds of thousands of dollars due to a block reorg that invalidated some of your trades. All dApp users benefit from near-instant finalities to avoid block reorgs.

In addition to finality, the price of transactions also affects the kinds of dApps that are accessible by the masses. We’ve already established that transacting on the Ethereum L1 is inaccessible for most people because of high fees, but dApps often require multiple transactions for a single user action, potentially multiplying transaction fees. For instance, a yield aggregator that routes through multiple sources may be accessible on a blockchain with low fees, but would be cost prohibitive for many on Ethereum mainnet.

Conclusion

In this article, we've covered how cryptocurrencies are a step-wise improvement in payments compared to traditional finance in terms of time-to-finality, risk reduction, and complexity, then evaluated the current state of Ethereum against third-generation blockchains using the same criteria. Finally, we covered the specific use cases, namely payments and dApps, where third-generation blockchains have a considerable advantage over Ethereum.

So, let’s return to the question: why don’t more people use cryptocurrencies?

The current market is dominated by platforms that have expensive and dynamic fees, long settlement times, and risk. Mass adoption must come from blockchains that are accessible to people with lower balances and demand less technical knowledge for robust operation and transaction. Third-generation blockchains generally provide an inexpensive, safer, and faster user experience that can scale to onboard the next generation of cryptocurrency users.

Disclaimer: This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The Tie Inc. The Author may be holding the token or using the strategies mentioned in this report. You are fully responsible for any decisions you make; The Tie Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post