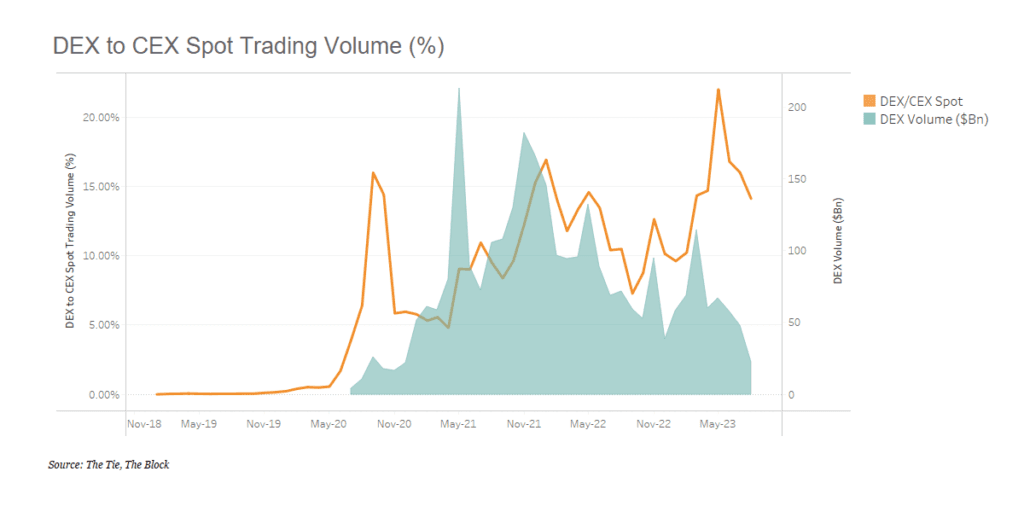

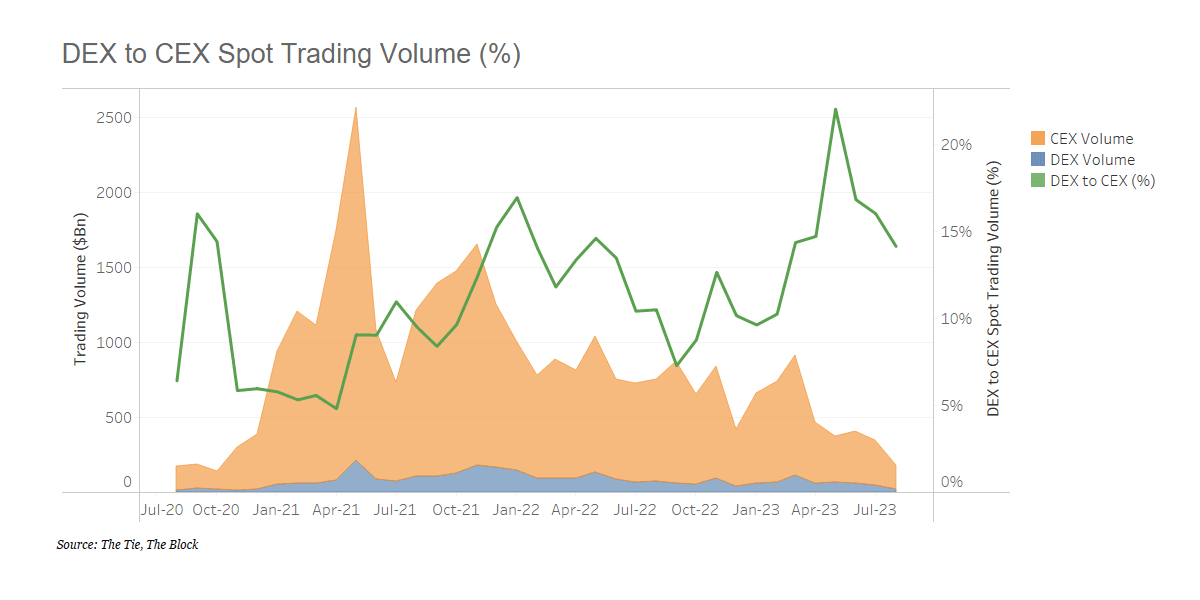

After the explosion of FTX, which was one of the most reputable crypto centralized exchanges (CEXs) in the world at the time, the exchange market share has slowly shifted to decentralized exchanges (DEXs). This shift comes as regulatory environments continue to remain unclear and unpredictable.

The Tie Research

Decentralized Exchanges: Current Limitations of AMM Models & Exploring the Future of DEX Mechanics

Even though DEXs poised to benefit from this murky and skeptical environment, they have faced their own challenges in establishing sustainable business models. AMM decentralized exchange, although one of the most innovative ideas that initiated the DeFi movement, appears to be unsustainable and challenging for liquidity providers to operate without subsidies from speculative funding in the form of rewarded tokens and incentive programs. Billions of dollars have poured into DeFi protocols and DEXs in the last few years, but the bootstrapping efforts have proven to be either ineffective or short-lived.

Once the liquidity incentive programs came to an end, trading fees alone were not enticing enough for many liquidity providers to keep their capital in the pools. The draining of liquidity, combined with the low capital efficiency of AMM DEXs, has led to high slippages. This, in turn, has made on-chain trading costs relatively more expensive compared to trading on centralized exchanges.

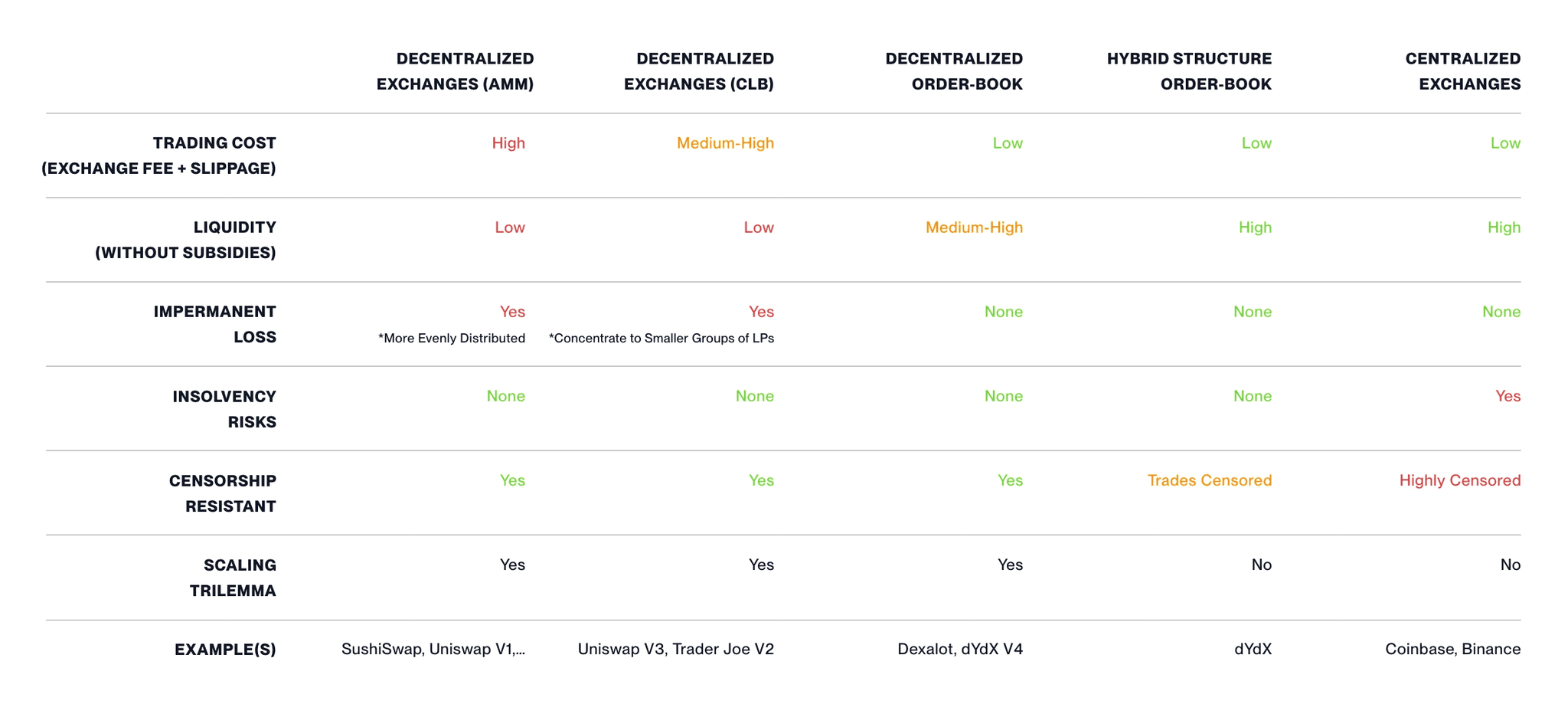

To help DEXs compete with CEXs, significant efforts are being made to innovate DeFi for lower slippage fees and higher capital efficiency to provide deeper liquidity. These approaches vary from further improving AMM models to introducing order-book matching in DeFi.

An example of the latter approach is dYdX, which has integrated order-book matching into its hybrid infrastructure. This integration has allowed their users to trade crypto assets with reasonable trading fees and a high level of liquidity, all without having to trust unprotected exchanges on a global scale. On the other hand, Uniswap V3 continues to dominate DeFi with over 60% market share by focusing on improving the AMM model. Both dYdX and Uniswap facilitate over $4 billion in weekly transactions, each paving their own way to bridge the gap between DEXs and CEXs.

Whether it's AMM, decentralized liquidity books, or hybrid structures like dYdX, each approach has its pros and cons. Which model will ultimately prevail in the crypto space? This piece will explore these tradeoffs in detail while looking toward the future with an investigation of innovative mechanisms within the DEX space.

Centralized Exchanges - The "Trust Me" Option That Requires Proper Protection from Local Governments

Centralized exchanges serve as depository financial institutions where users can deposit their fiat or crypto assets to buy (or sell) crypto assets within their trading accounts. All trading activities settle off-chain and only transfer back to on-chain when users wish to withdraw their cryptocurrencies to their public blockchain addresses. However, unlike traditional stock brokers (or exchanges) trading accounts, these accounts are not FDIC insured in the event that the exchanges become insolvent. Considering that many countries around the world still lack clear regulatory frameworks for crypto assets, crypto asset investors are not as protected by authorities as investing in other asset classes. Consequently, they have to trust the available centralized exchanges without insurance or protection from their local authorities.

Prior to and during the FTX collapse, there was no regulatory authority with sufficient oversight to protect crypto asset investors from the alleged fraud that occurred within FTX's internal operation, even though this depository institution held custody of billions of dollars. Nevertheless, investors who have faith in cryptocurrencies sought alternative, trustless-based options for trading their crypto assets - the decentralized exchanges.

Decentralized Exchanges

One of the most fundamental differences between centralized exchanges (CEXs) and decentralized exchanges (DEXs) lies in trust assumptions. Given the uncertain crypto regulations prevailing worldwide, the ownership of crypto assets is not protected by many authorities. As a result, it appears safer for market participants to self-custody their cryptocurrencies and conduct trading activities on-chain. Decentralized exchanges enable users to interact with smart contracts to swap crypto assets permissionlessly on-chain, with all transactions and trades settled on public ledgers in real-time.

However, while this solution can help Web 3.0 enthusiasts mitigate exchange solvency risks and may seem like an ideal solution, trading costs become a significant consideration when choosing between decentralized exchanges and centralized exchanges.

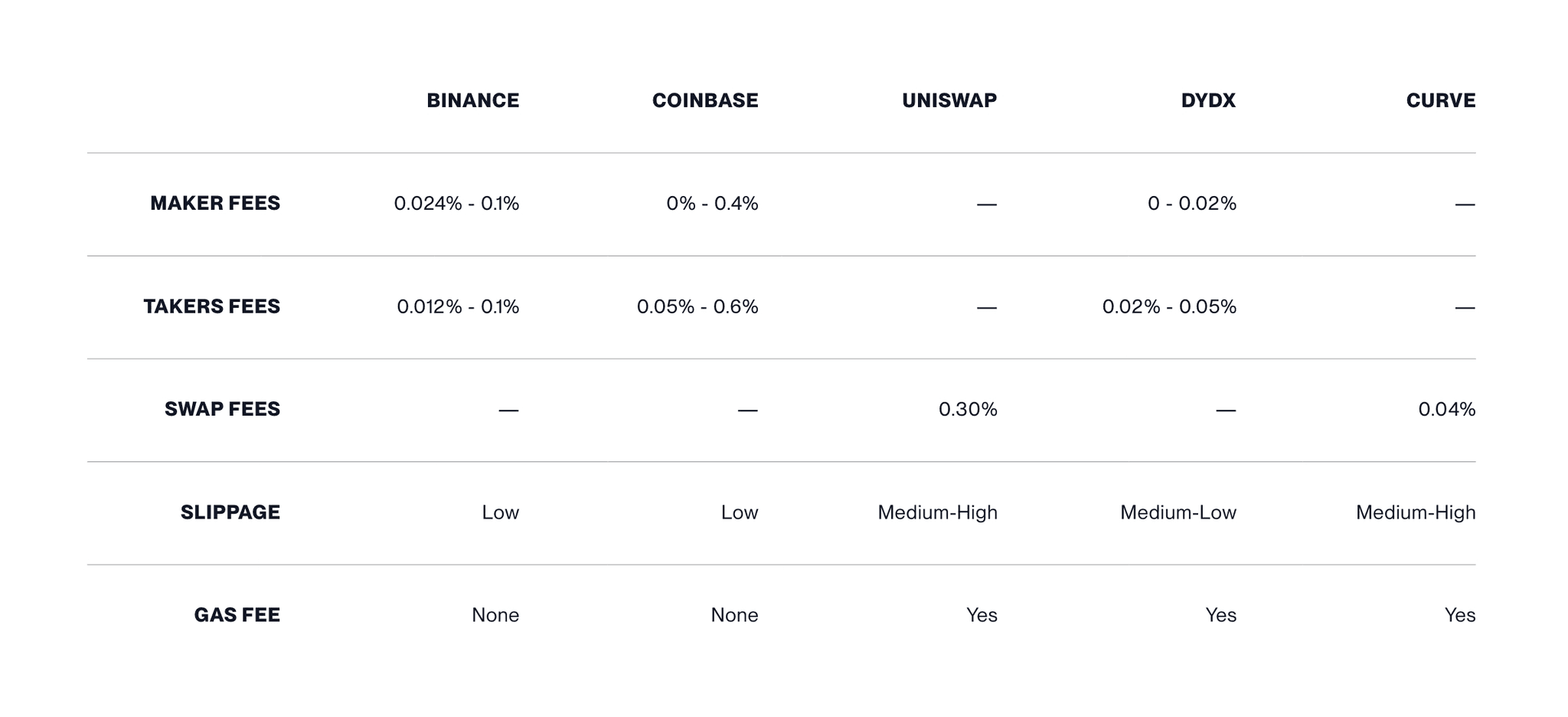

Centralized exchanges often charge fees ranging from 0.1% (e.g., Binance) to 0.6% (e.g., Coinbase) per trade. In contrast, decentralized exchanges charge between 0.04% (e.g., Curve) to 0.3% (e.g., Uniswap, SushiSwap, PancakeSwap); dYdX offers 0.02% for perpetual trading, in addition to network gas fees per transaction, which can range from a fraction of a cent to $10 on the Ethereum network (equating to an additional 0.001% to 0.5% of a $2,000 trade).

When considering exchange fees alone, some decentralized exchanges (DEXs) offer even lower fees compared to major CEXs. However, due to slippage fees resulting from lower liquidity levels on DEXs, the total trading costs (comprising exchange fees and slippages) on decentralized exchanges often exceed those of centralized exchanges.

Liquidity and Slippage

Liquidity refers to the ability to buy and sell trading assets without causing significant movements in their prices, and with minimal slippage. Slippage represents the difference between the expected price of an order and the price at which the order is executed, which is often considered a hidden fee in trading. A high level of liquidity helps reduce slippage, making the trading cost more attractive to users.

In cases of low level of liquidity on AMM pools, slippage can account for up to 1% of transaction value (or even 10% for illiquid trading pairs), making trading on DEXs significantly less appealing compared to trading on CEXs. Consequently, users must choose between accepting the exchange's solvency risk or trading on DEXs with higher trading costs (comprising exchange fees and slippage fees).

In exchanges that leverage order-book matching mechanisms, market makers profit by maintaining capital in stock on exchanges, matching higher bids with lower asks to profit from spreads. The presence of market makers on exchanges significantly enhances liquidity by increasing trading volume. To incentivize market makers deploying their capital, exchanges often negotiate deals with them for discounted trading fees. These arrangements benefit both parties: exchanges gain deeper order books, and market makers improve their operating margins on deployed capital.

On the other hand, AMM pools require the presence of liquidity providers as the primary source of liquidity (not just liquidity enhancers). Significant funding is required for DeFi incentive programs in the form of rewarded tokens to incentivize liquidity providers to keep their capital in the liquidity pools. However, with rising interest rates and dwindling funding availability, incentive programs have diminished across various chains, resulting in a significant decentralized liquidity drain. This has led enthusiasts to question the sustainability of the current standard growth model of DeFi.

Impermanent Loss - The Real Catch in DeFi Liquidity Provision

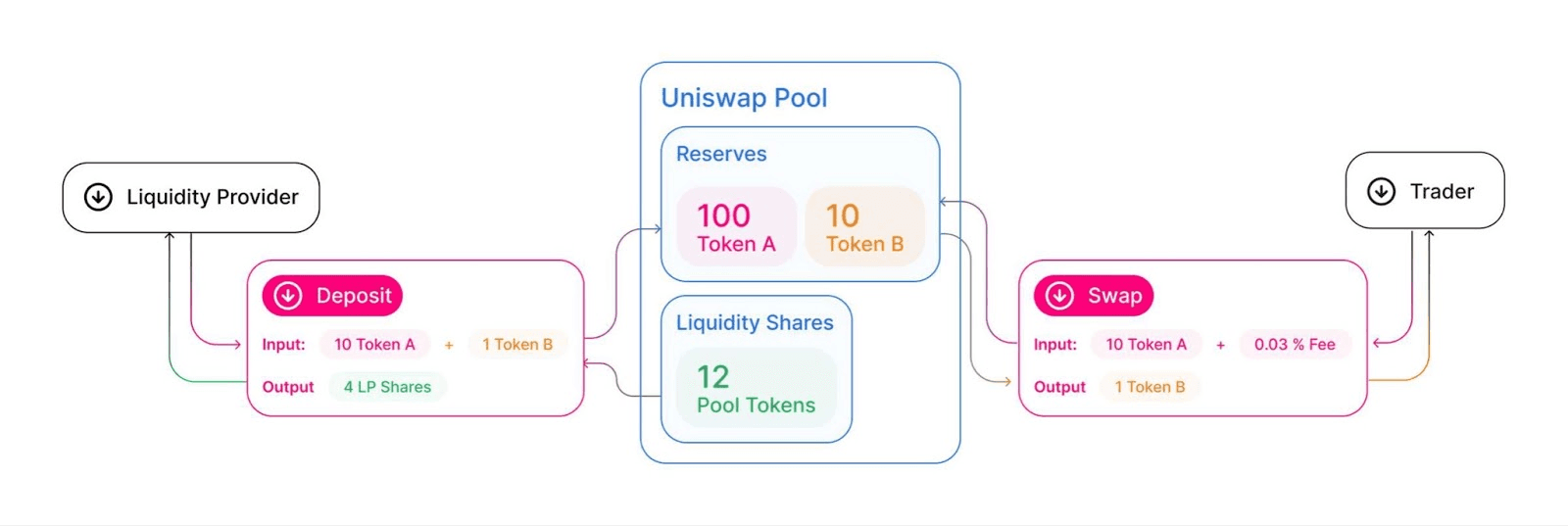

Automatic Market Maker (AMM) pools were the innovation that kickstarted the entire DeFi movement. In simple terms, an AMM smart contract functions like an over-the-counter (OTC) robot, enabling users to exchange their desired tokens with those available in the paired tokens within the pool. The creation of Automated Market Makers (AMMs) has been a breakthrough, enabling crypto users to swap and trade on-chain without depending on centralized third parties on a global scale.

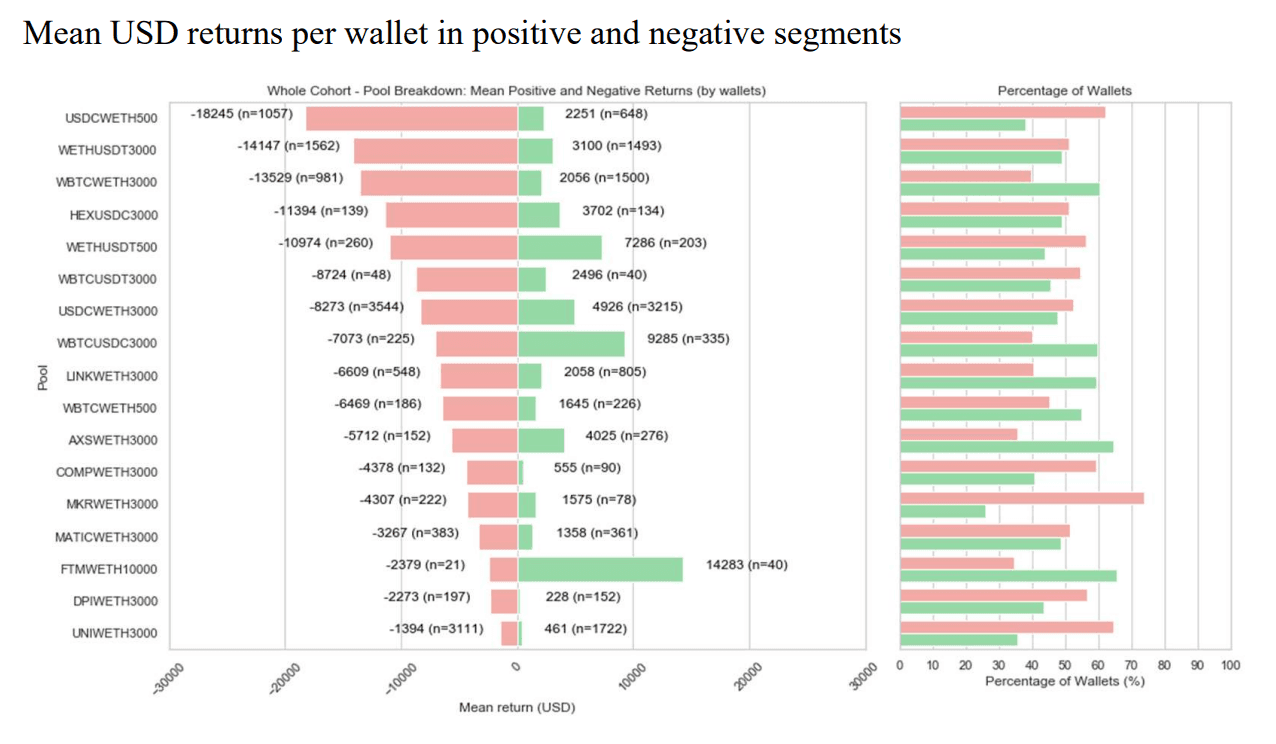

Liquidity providers are the primary source of liquidity who deposit pairs (or groups) of crypto assets into these pools, expecting to earn trading fees and rewarded tokens in return. However, a study on Impermanent Loss in Uniswap v3 revealed that half of the liquidity providers on Uniswap V3 - the largest DEXs with over $4Bn weekly trading volume - yielded negative return, while the majority of the winning half performed poorly when adjusted for inflation, all due to impermanent loss.

Most liquidity providers (LPs) and DeFi enthusiasts have come to realize that impermanent loss (IL) is the real catch in high-yield DeFi farming. Impermanent loss represents the risk of having returns that underperform compared to simply holding the tokens and doing nothing.

For instance, consider a group of investors providing liquidity to the ETH-USDC pool with 10 ETH and 17,000 USDC. A crypto enthusiast named Vitalik comes to the pool and swaps 1,700 USDC for 1 ETH. Now, the pool holds 9 ETH and 18,700 USDC, and the price of ETH rises from $1,700 to $1,800. The total net worth of these liquidity providers becomes $34,900 (9 ETH @$1800 + 18,700 USDC) instead of $35,000 (10 ETH @$1,800 + 17,000 USDC). The difference of $100 represents the impermanent loss.

Due to the significant hurdle posed by impermanent loss, DeFi protocols had to issue rewarded tokens on top of shared swap fees to incentivize liquidity providers to keep their capital in the pools. These rewarded tokens were liquid, and their prices continued to trend upward during the bull market, making AMM (Automated Market Maker) pools appear to be such a great "free lunch." However, as trading volumes began to decline and the 'cheap money' subsidies dried up, liquidity providers faced increasing challenges in remaining profitable, compounded by the rising cyber security risk of exploitation. Consequently, many of them chose to withdraw their funds and exit the pools.

Liquidity Programs - Failing to Establish Long-Term Moats for AMM Pools

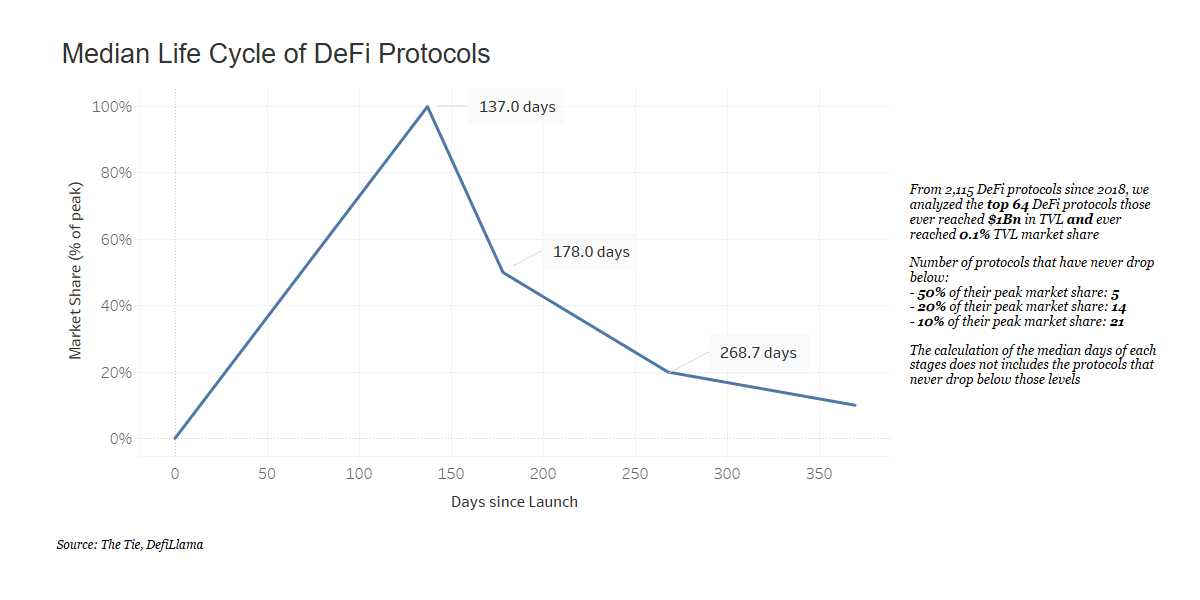

Many protocols have allocated their raised capital to incentive programs, often involving the distribution of rewarded tokens with the primary goal of attracting liquidity providers and users. Still, these incentive programs have generally led to short-lived cycles for DeFi protocols. We conducted a data analysis on a sample size of over 2,115 protocols dating back to 2018. We further narrowed our analysis to focus on the most successful protocols, totaling 64, which were able to achieve at least 0.1% of the Total Value Locked (TVL) market share and exceed $1 billion in TVL at some point in their existence.

Even among these top 64 DeFi protocols, their life cycles were relatively short-lived when measured by retained liquidity (TVL). They typically took around three to four months to reach their peak TVL market share (in %), as liquidity and community engagement gained momentum. However, they then experienced rapid declines in the subsequent month or two, often reaching just 10% of their peak liquidity market share in a year.

Once the liquidity incentive programs came to an end, trading fees alone were not enticing enough for many liquidity providers to keep their capital in the pools. As a result, a significant portion of the capital was withdrawn from the pools, leading to increased slippages and driving users away. This downward spiral in transaction activity quickly transformed these exchanges into ghost towns.

Further Innovating the AMM Model or Bringing Order-Books to DeFi

To address the challenges of liquidity provision and competitiveness in the crypto exchange market, two popular innovative approaches have emerged, shedding light for DeFi enthusiasts: continuous innovation of AMM models and the introduction of replicated order-book matching infrastructure.

First Approach: Innovating AMM Models

Over the three-year lifespan of DeFi, several variants have spun off from the original AMM model - Constant Product Market Maker (CPMM), such as Constant Sum MM (CSMM) or Hybrid Constant Function MM (Curve). However, none of them have successfully addressed the impermanent loss (IL) problem and have primarily focused on reducing slippage.

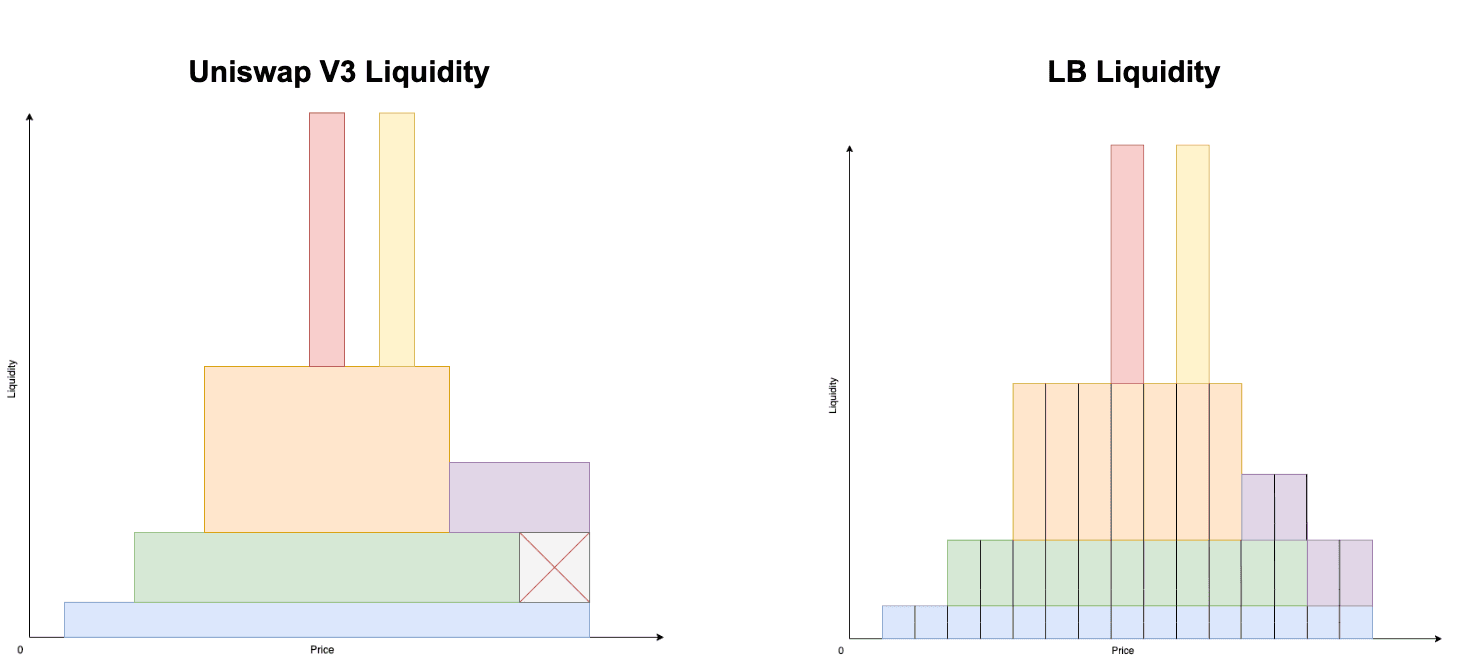

Uniswap V3, the largest AMM DEX in terms of trading volume, introduced the concept of concentrated liquidity books (CLB). This feature allows liquidity providers (LPs) to concentrate their capital within a specific price range, thereby deepening the book for better liquidity utilization in AMM pools. Recently, Trader Joe has built upon the idea of concentrated liquidity books (CLB), introducing price bins to provide even greater flexibility for Liquidity Providers (LPs).

For instance, suppose the current ETH price is $1,700. Liquidity providers can now choose to concentrate their capital within a specific price range, such as between $1,650 and $1,750. This is why it's called concentrated liquidity.

Although these changes can improve the depth of the order books and reduce slippage when the price is not too volatile, they do not reduce impermanent loss for liquidity providers as a whole. With the IL evenly distributed in standard AMM models (CPMM), the IL in concentrated liquidity books (CLB) now concentrates on those liquidity providers who cannot redistribute their capital quickly enough when prices move beyond their allocated ranges*.

*Suppose you have 1 ETH and 1,700 USDC, and you decide to provide liquidity for the price range between $1,650 and $1,750.

- When the price moves to $1,800, your bins are quickly emptied (your ETH is now cheaper compared to the market price), and all your ETH is converted to USDC. You are now holding 3,400 USDC instead of $3,500 (1 ETH @$1,800 and 1,700 USDC).

- When the price moves to $1,600, all the USDC in your chosen pool is quickly emptied (because people can buy cheaper ETH and swap it in your pools), leaving you holding 2 ETH and 0 USDC, which is worth $3,200 instead of $3,300.

Simply put, if the price of the asset falls below $1,650 or rises above $1,750, liquidity providers who do not automate rebalancing will incur significant impermanent losses.

The only situation in which LPs can profit from providing liquidity for concentrated pools is when the price stabilizes with high trading volume, allowing swap fees to exceed the impermanent loss (IL). Another study conducted by the ETH Zurich team on Risk and Returns of Uniswap V3 LPs revealed that impermanent loss is zero only when the price remains unchanged compared to the initial price of liquidity injection. Otherwise, the IL will always be negative, regardless of whether the price moves up or down.

One potential approach to address this challenge could be to consider a revision in the swap fee structure. For instance, Trader Joe introduced the volatility accumulator, known as “surge pricing mechanism”. This mechanism aims to incentivize liquidity providers for the volatility of the market by imposing variable fees on users, thereby rendering trading on the DEX less appealing in terms of cost.

While increasing swap fees can enhance the profitability of liquidity providers, it does so at the cost of reducing competitiveness, potentially driving users to other decentralized exchanges (DEXs) and centralized exchanges.

Second Approach: Bringing Order-Book Matching to DeFi

dYdX, a permissionless crypto exchange, serves as an interesting case study for the order-book matching mechanism. dYdX founder Antonio Juliano believes that this mechanism is superior to AMM alternatives at achieving high levels of liquidity. The dYdX team opted for a hybrid infrastructure that combines on-chain settlement with an off-chain low-latency matching engine equipped with order books. Market makers operating within the dYdX platform have predominantly emphasized algorithmic approaches, making use of APIs. After a user initiates a trade and it finds a match, the settlement is deterministic. dYdX has validated its principles by emerging as the second-largest decentralized exchange in the market, second only to Uniswap. It has facilitated an average weekly trading volume of over $7 billion this year.

Dexalot, another protocol with a similar goal of replicating the trading experiences of centralized exchanges on Avalanche, takes a slightly different approach. Instead of employing an off-chain matching engine like dYdX, the Dexalot team leverages subnet infrastructure and the LayerZero messaging protocol to achieve low latency with minimal transaction fees. Nevertheless, the blockchain scaling trilemma remains a primary concern with this approach. Higher trading volumes with more orders in the books translate to increased data and transaction processing demands on the network. Market-making operations also necessitate high-frequency trading activities, such as updating price quotes and transmitting cancellation metrics across multiple exchanges.

In 2013, the US Securities and Exchange Commission (SEC) reported that 96.8% of all orders were canceled before they were executed, with 90% of them canceled within one second.

Hence, exorbitant transaction costs could discourage market makers, potentially leading to reduced liquidity as the structure scales further toward the decentralized end of the spectrum. Conversely, using a centralized structure in DeFi is seen as a security bottleneck by decentralization advocates and crypto enthusiasts who doubt regulators' willingness to facilitate the growth of such innovations.

Whether it's AMM, decentralized liquidity books, or hybrid structures like dYdX, each approach has its pros and cons, along with both believers and skeptics. Only time will reveal which approach gains more popularity over the next few years, especially if the crypto market picks up again.

Wrapping Up

Regardless of which DEX model wins the day, the most significant competitors for any DEX will continue to be centralized exchanges. While the growing popularity of DEXs over the last three years may lead some to believe that decentralized exchanges will eventually dominate exchange market share, this prediction is based on a strong assumption: that crypto regulatory frameworks around the world will remain unclear and unpredictable.

Even after the shocking collapse of FTX, resulting in the loss of billions of dollars, the total trading volume on centralized exchanges is still five-fold that of decentralized exchanges. Though trust in centralized exchanges is down, the majority of users have chosen to maintain faith in these platforms instead of navigating the steep learning curve of using crypto wallets or tolerating the high trading costs of DEXs.

Assuming that cryptocurrency continues to gain adoption worldwide, regulators will increasingly recognize the need for heightened protections for crypto investors. As regulatory uncertainties continue to be a significant disadvantage for CEXs, DEXs should seize the opportunity to expedite their development processes and elevate their offerings before CEXs potentially regain their bargain in the next few years with more regulation clarities.

Although centralized exchanges may lack the censorship-resistant characteristics compared to DEXs, they provide valuable on/off-ramp services and the general benefits of greater market competition. DEXs and DeFi services in general will need to continue innovating to provide even better services in the future, ultimately driving the growing adoption of DeFi.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post