Sandclock aims to revolutionize philanthropy by creating systems that incentivize charitable donations. To do this, they must craft yield opportunities that are sustainable, scalable, and accessible to everyone.

The Tie Research

Sandclock: Innovating Philanthropy Through Crypto Primitives

Introduction

Up until this point, users could donate directly to charitable organizations using crypto, but actual innovation beyond that was fairly limited. Sandclock draws on classic crypto-native primitives like mining, yield-farming, and a new token, QUARTZ, to incentivize opportunities for efficient charitable giving.

Charity Mining

Charity mining is an innovative mechanism that uses a portion of token distribution to incentivize donations. 37% of total supply gets locked up forever, and the only way for users to access these tokens is through, you guessed it, donating.

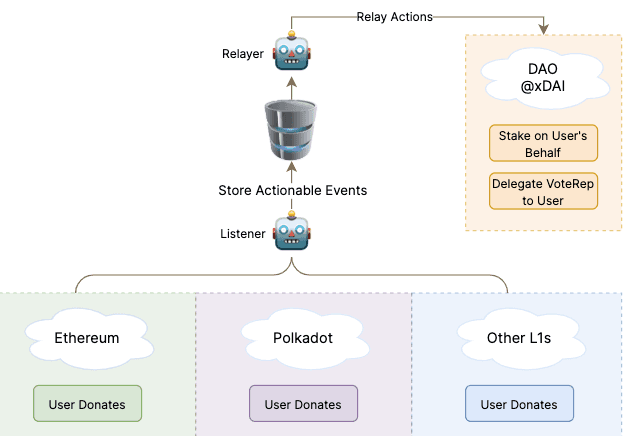

It’s important to note that users don’t receive these tokens in their wallets. Instead, upon making a donation through Sandclock, the protocol automatically delegates a certain portion of the permanently locked QUARTZ to the user via cross-chain relayers. At the current time of writing, these tokens are only usable for governance voting and treasury management. However, after speaking with their team, Sandclock mentioned an upcoming feature where donors will receive a boosted APY. This system is non-inflationary, non-dilutive, and is directly in line with Sandclock’s mission-striving to make an impact by incentivizing others to give.

Example scenario:

- Our friend John stakes $100,000 inside one of Sandclocks stablecoin vaults. Let’s assume the APY meets their target, at 30% (the actual APY will depend on the vault used, as each vault consists of a different yield strategy).

- John decides he wants to donate 20% of his yield to a charity foundation of his choice.

- After one year, Sandclock has donated $6,000 of his $30,000 yield profit. As John’s donations go through, Sandclock also automatically delegates QUARTZ based on his donations to the Sandclock DAO on his behalf. This gives him governance voting power, along with more exposure to QUARTZ.

Yield Re-direction

While donations are a massive part of Sandclock's mission, it’s understood that not everyone is in a position to donate their yield. With this in mind, it’s important to note that Sandclock is a yield optimizer at its core. Users can leverage the platform by:

- Auto-compounding yield

- Directing portions of their yield to different addresses

- Zero-loss donations

- Bootstrapping liquidity for new projects by incentivizing users to direct a portion of their yield in exchange for tokens.

Cross-chain relayers support directing yield, giving depositors the ability to direct yield to any chain. This opens up a myriad of different use-cases, limited only by the imagination of the users. You could theoretically:

- Use Sandclock to build up an LP or staked position on a different yield platform, such as Bancor (I.e., sending 80% of your yield into a LINK/BNT pool)

- Diversify your portfolio through Sandclock to automatically sell your yield into an asset of your choice.

- Pay yourself periodically with yield into a pre-paid debit card.

- Automate delta-neutral strategies

It’s also important to note that because Sandclock utilizes cross-chain relayers, they’re able to source the best yields from any chain, ensuring a consistently high APY as their algorithms rebalance and self-optimize.

Optimized Taxes

Charitable contributions remain one of the most tax-efficient saving methods available. As long as the organization is a 501(c)(3) public charity or private foundation, a donor is eligible to receive a tax receipt that acts as a record of their contribution.

Since NFTs gained mainstream popularity, there have been numerous speculative conversations on tax-optimization utility. Still, actual innovation has been slow up until this point.

Sandclock took the concept of tax deductions through charitable donations, and created an on-chain proxy- NFT Tax Receipts. These NFTs contain all the information that a traditional tax receipt would provide, and are valid in any jurisdiction. Once a donor is ready, they can burn the NFT to receive their tax receipt off-chain through Sandclock.

You can read more about Sandclock's plans for NFT Tax receipts here.

Charity Raffles

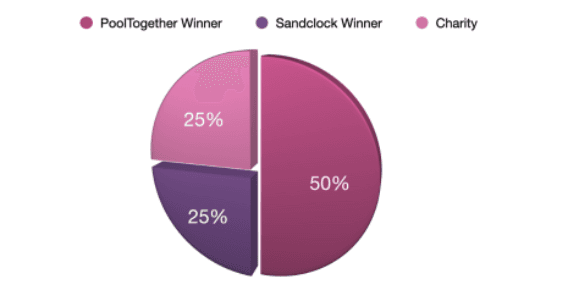

To further incentivize donations, Sandclock has partnered with PoolTogether to create quarterly raffles. Tickets to these raffles are rewarded to donors for every dollar donated through Sandclock’s platform. Every quarter, 50% of the proceeds accumulated by PoolTogethers raffle go to the winner of the pool, 25% go to a charity foundation decided by PoolTogether, and the other 25% goes to the winner of Sandclock’s raffle.

With the rise of side-chains further dividing users, cross-chain composability has become a necessity for blockchain adoption to be achieved on a massive scale. Sandclock’s partnership with PoolTogether demonstrates a willingness to work toward that end. Sandclock intends to leverage its architecture to create cross-chain routing vaults, enabling liquidity transfer from one blockchain to another.

Sale & Allocation

On May 9th, 2021, Sandclock made history as the first protocol to successfully execute a multichain pre-sale. Their pre-sale ran with unprecedented volume, selling out in less than 3 minutes. Investors who were able to receive an allocation during Phase One of Sandclock’s two-part sale acquired the native token, QUARTZ, at $1.00, with a maximum allocation of $35,000 per wallet, and a total cap of $3 million.

Fast-forward five months to October 23rd, 2021, Phase Two of Sandclock’s sale raised an additional $14.26 million. Originally, the plan was for investors who deposited in Phase One to have their total allocation available after Sandclocks LBP (Phase Two).

The issue was that the volume Sandclock initially received far exceeded their expectations, putting Phase One investors in substantial profits (at one point up to +2500%). If made immediately available on the market, there would have only been enough liquidity for 10% of investors to cash out. This would leave the remaining investors without a way to sell, and create extreme price deviation to the downside for QUARTZ. With this in mind, they decided to enact a vesting period of 100 QUARTZ per day, until they reached $100mm of liquidity, at which point they would then scale up distribution.

Distribution Notes:

- 7% of $QUARTZ total supply is allocated to OTC sales. Sales vest over 3 years, and the team will only call on them if they run out of development capital.

- 30% permanently locked for charity mining, as discussed earlier.

- 2% permanently locked for insurance.

- 5% permanently locked & staked. Yield is redirected into charity, voted on by governance.

- 30% distributed to the treasury for protocol development and liquidity mining.

- 20% allocated to the team, vested over 3 years.

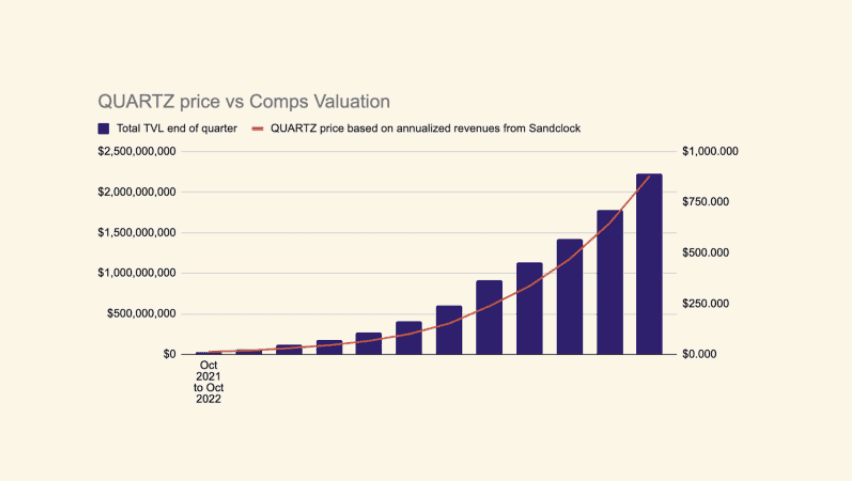

QUARTZ Valuation Projection

As shown in Figure C, Sandclock's native governance token, QUARTZ, is extremely responsive to TVL. Based on the team’s valuation model, at $500mm TVL, the price of QUARTZ would be pegged at around $250.00, a 2821% price increase from its current price of $8.86. With that said, these estimated projections do not necessarily consider the full scope of the value accrual mechanisms for QUARTZ in either direction.

Quartz Use case

QUARTZ is a utility token, with governance being its primary role. In order to address gas constraints that come with governance on mainnet, Sandclock’s DAO is located on Polygon where holders can vote or delegate their votes to others for proposals affecting:

- Treasury Management

- Partnerships/Integrations

- Quarterly charitable donations (through the treasury)

- Pools & Parameters modification

They’ve also adopted a novel voting mechanism called Conviction Voting. You can read more about it here.

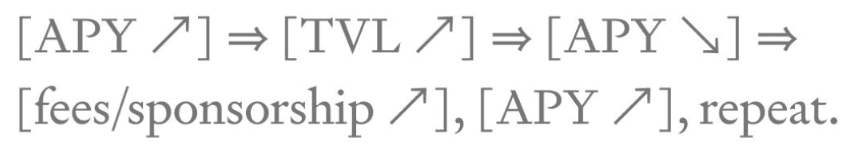

Boosted Vaults

Sandclock takes a 20% performance fee from vaults. These fees are stored directly in the treasury, and then are staked. The yield that the treasury accrues is then distributed to depositors who stake QUARTZ. Not only does this add value to QUARTZ, but it also creates a positive feedback loop between APY, TVL & performance fees.

While speaking with Sandclock’s CEO, Cristiano, he expressed that there are plans to optimize tokenomics in order to expand the different use-cases for QUARTZ.

Team

Sandclock’s team currently consists of 12 members, 5 of which are full-time smart contract developers, and they are actively hiring. This doesn’t include the team members from their partner company Lindy Labs, who are helping to conduct formal verifications of their protocol architecture. To learn more about their core team members, visit the site.

Audits

- Christoph Michel (top 4rena leaderboard auditor)—Audit File

- Solidity and CosmWasm audits done by Solidified & Oak Security(formerly known as Cryptonics)—Audit File

- Contract signed with Trail of Bits, who arguably has one of the best track records in the space. No confirmed date, but we can expect another set of audits to be done in May or June.

Final thoughts & noteworthy mentions.

- Sandclock will be offering built-in insurance for reduced APY to institutions (and later made available to everyone). There is institutional interest from bank treasuries, who will join a pilot when Sandclock is ready.

- The 20% performance fee is not set in stone. Governance voters have the power to change this. Cristiano mentioned that once deployed on Starknet, performance fees should decrease due to inherently lower gas fees.

- Sandclock has partnered with OHM, and has been using Olympus Pro bonds to build their POL (Protocol Owned Liquidity). They also have plans to utilize UMA’s KPI options to incentivize liquidity. Further reading here.

- Sandclock spoke at the 26th Annual United National General Assembly (UNGA) in NYC. Further reading here

- Inc Magazine recently featured Sandclock. Article here

- Proper certifications necessary for NFT Tax Receipts are already in place with the IRS. Since Sandclock first appeared, there has been a big emphasis on being regulatory compliant.

- In August 2021, Sandclock hosted a 2-hour Philanthropy summit, with guest speakers including Raoul Pal, Do Kwon, Kevin O’Leary, and more. Recording link here

- Sandclock is working together with Burocratik, a world-renowned digital branding company, to create a seamless user experience and new UI.

- v1 is launching within the next month, although it depends on the final audits.

- Sandclock’s vaults will support USDC, UST & DAI at launch with a projected APY of 30-60%.

- Sandclock's flagship strategy is basis trading with PoS (proof of stake). When funding rates are favorable, capital is used to short perpetuals, buy spot and stake it. Combined with leverage, it will be interesting to see how this strategy functions in real time as they scale it through the inclusion of other PoS assets like ETH, LUNA, AVAX, etc

They’re a new player in the space with innovative ideas, and a hard-working team with a genuine care for the mission they’re looking to achieve. With that said, everything talked about in this article is experimental, and is subject to change as the protocol goes live.

This report is for informational purposes only and is not investment or trading advice. The views and opinions expressed in this report are exclusively those of the author, and do not necessarily reflect the views or positions of The TIE Inc. The Author may be holding the cryptocurrencies or using the strategies mentioned in this report. You are fully responsible for any decisions you make; the TIE Inc. is not liable for any loss or damage caused by reliance on information provided. For investment advice, please consult a registered investment advisor.

Sign up to receive an email when we release a new post