Sentiment API

The Most Complete Sentiment API in Crypto

The Tie's Sentiment API provides real-time, complete, and actionable data on crypto's most active social network.

The world's most sophisticated quantitative hedge funds leverage The Tie's Sentiment API to build and augment their trading strategies to drive alpha in an increasingly competitive landscape.

Contact UsKey Benefits

The Tie Sentiment API

Comprehensive & Real-Time Data

The Tie's Sentiment API provides real-time, complete, and actionable sentiment data on social.

The Tie's Sentiment API provides real-time, complete, and actionable sentiment data on social.

Extensive Data History for Backtesting

Sentiment API offers point-in-time, out-of-sample social data going back to 2017 on more than 1000+ cryptocurrencies.

Sentiment API offers point-in-time, out-of-sample social data going back to 2017 on more than 1000+ cryptocurrencies.

Actionable Indicators for Strategy Building

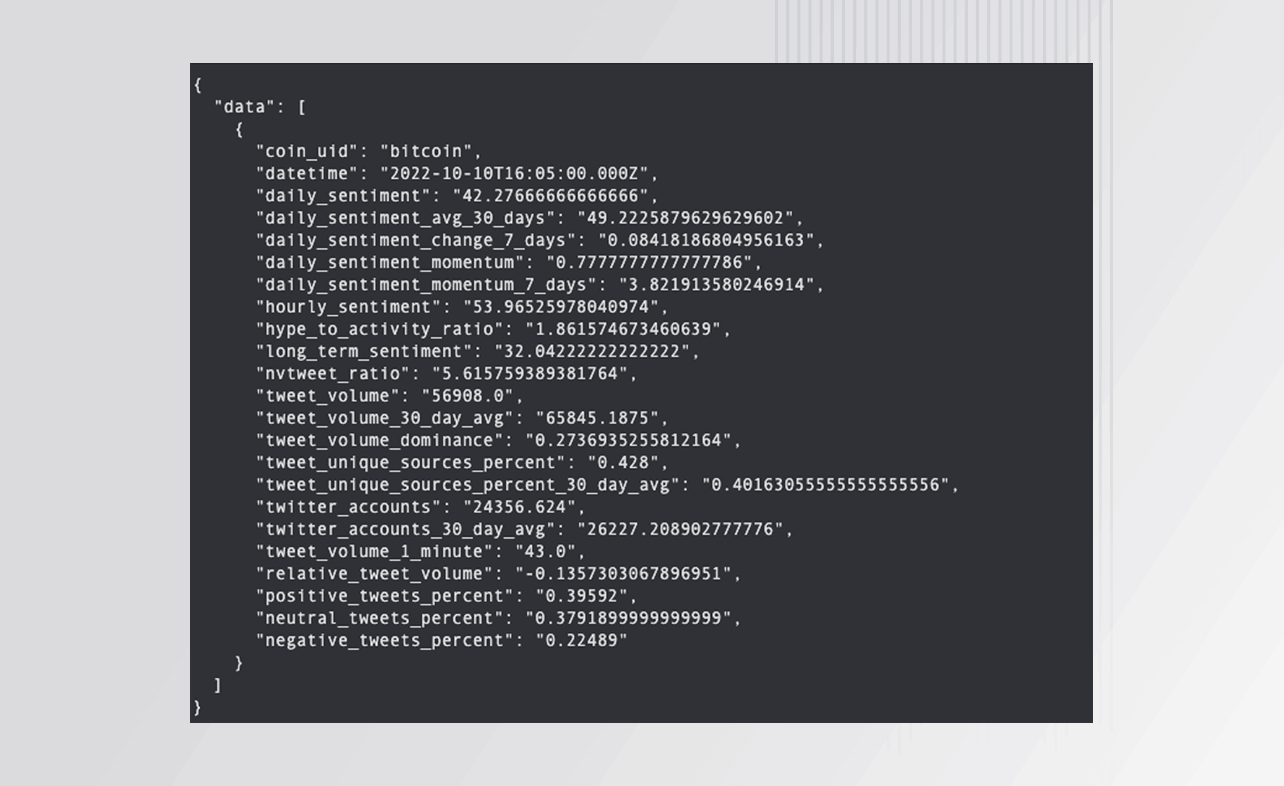

The Sentiment API features both raw volume metrics and quantified measures of investor sentiment with varying lookback periods and frequencies.

The Sentiment API features both raw volume metrics and quantified measures of investor sentiment with varying lookback periods and frequencies.

A closer look at

Sentiment API

5 Years of Data History

5 Years of Data History

Extensive Sentiment Data

- Access historical sentiment data on 500+ cryptocurrencies since 2017.

Validate Strategies

- Backtest and build conviction in your trading models using The Tie's comprehensive data.

An Array of Actionable Indicators

An Array of Actionable Indicators

Comprehensive Sentiment Metrics

- Get raw metrics (e.g. count, unique accounts) and sentiment metrics (raw and normalized) with various lookbacks and frequencies.

Versatile Data

- Utilize years of data for both long-term and high-frequency strategy building.

Improve the Accuracy of Your Trading Strategies

Improve the Accuracy of Your Trading Strategies

Trusted by Leading Hedge Funds

- The Tie's Sentiment API is used in production by top hedge funds to improve model accuracy.

Generate Alpha

- Discover how our clients leverage The Tie's market-leading Sentiment API to identify profitable opportunities.

Explore The Tie's APIs and Datasets

News API

Bring The Tie’s best-in-class News coverage into your quantitative models, including news from 4,000+ sources, 4+ years of point-in-time, out-of-sample data.

LEARN MOREToken Unlock API

Integrate our best-in-class Token Unlock Data via API. 100,000+ historical unlock events allow for thorough backtesting, enabling quantitative funds to be well-positioned for future unlocks.

LEARN MOREDeveloper Data

Contextualize the health of a token’s developer community. Understand which projects are gaining or losing developers, benchmark a project’s developer activity against competitors, and follow key developer movements to new projects.

LEARN MOREOn-Chain Data

The Tie’s crypto-native data expertise translates raw blockchain transaction data into proprietary comparative metrics and clear, meaningful insights.

LEARN MOREPrivate Company & Investor Data

Track key fundraising, growth, news, and investment metrics for 1,000+ Private Companies and 500+ Funds in digital assets.

LEARN MORESocial Media & Sentiment Data

More than a dozen metrics provide deep insight into Social Media conversations across leading platforms.

LEARN MOREToken Unlock Data

Manually-vetted coverage of future and historical unlock events for 100+ tokens, to analyze historical market impact and make informed decisions around future unlocks.

LEARN MORESentiment API

Improve your quantitative models with our best-in-class Sentiment API. The Sentiment API provides both raw conversation volumes and quantified sentiment, with various lookbacks and frequencies.

LEARN MORETalk to an Expert

Connect with our team to see how The Tie’s APIs can improve your quantitative models.